Resilience & Performance

Over the last six decades, the S&P 500 Index has embodied the resilience and ever-evolving nature of the stock market. Currently, we are witnessing a fascinating chapter in this narrative. Despite robust economic growth and escalating interest rates, the S&P 500 has impressively climbed over 24% to date. This exceptional performance occurs amidst a stable unemployment rate, recorded at 3.7% in November, alongside inflation rates that are beginning to show signs of easing.

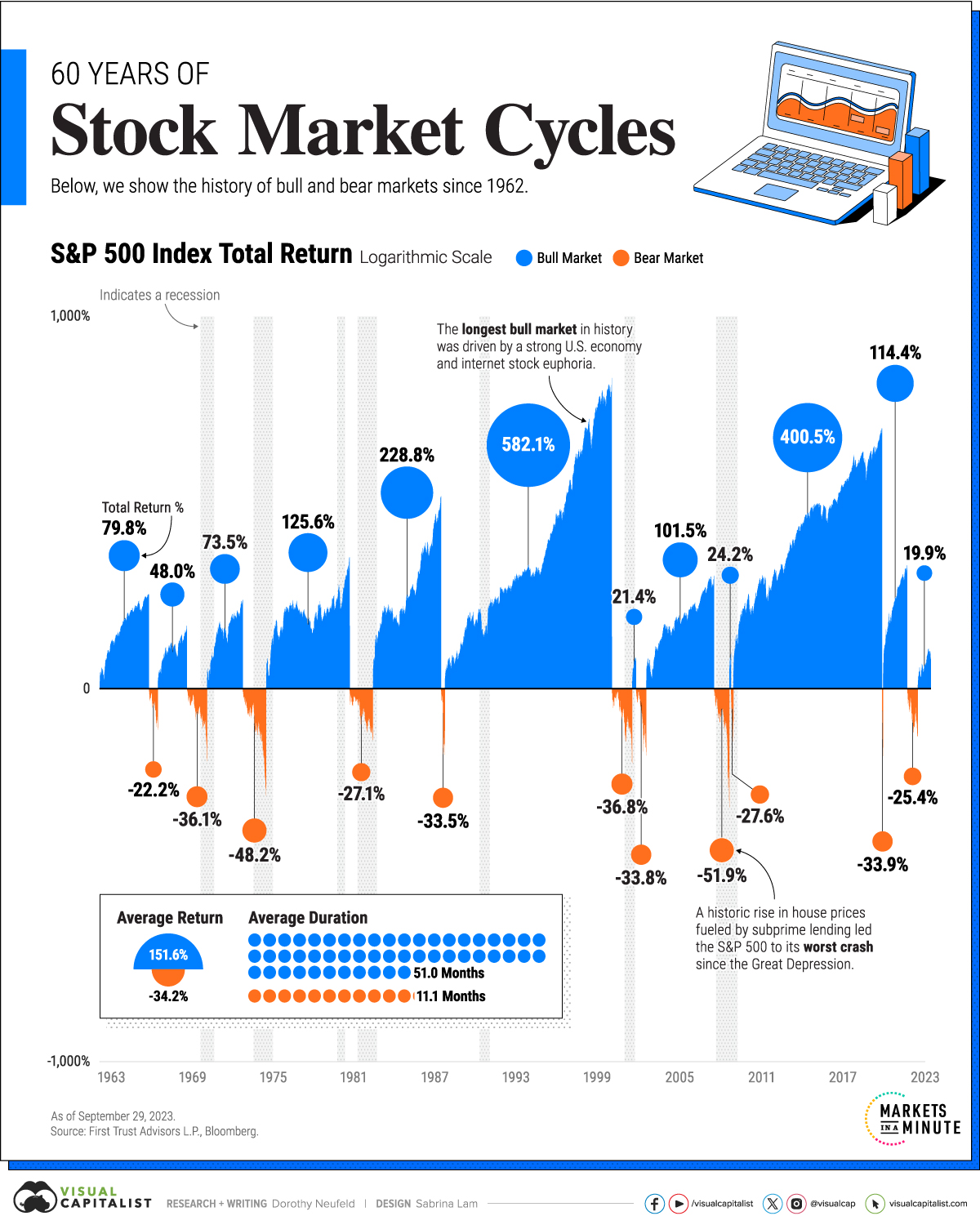

Understanding Market Cycles: Bulls and Bears

The stock market’s cyclical nature is marked by alternating bull and bear phases. A bear market, identified by a decline of 20% or more from a market index’s peak, signals a downturn. In contrast, a bull market signifies a rebound and a rise above the previous peak, which can span months or years.

An analysis of historical data since 1962 reveals these patterns:

Bull Markets: Typically, bull markets have average returns* of +151.6% and have an average duration of 51.0 months.

Bear Markets: In comparison, bear markets have witnessed an average decline* of -34.2%, typically lasting 11.1 months.

* As of September 29, 2022

Notably prolonged bear markets in the early 1970s and 1980s, each extending around 20 months, were largely driven by high inflation and Federal Reserve’s monetary policies leading to recessions. The year 1974, for instance, saw a drastic 48.2% fall in the S&P 500, one of the sharpest post-WWII downturns.

The 1990s: A Decade of Prosperity and the Bull Market

The 1990s experienced the longest bull market, driven by a strong U.S. economy, culminating in the Dotcom bubble. Over 12 years, the S&P 500 surged by 582.1%. Following the 2008 Global Financial Crisis, another significant bull market emerged, lasting 11 years, marked by low-interest rates and the rapid growth of major tech companies.

Market peaks often herald economic recessions. For instance, the S&P 500 peaked in October 2007, shortly before the recession onset in December. Similarly, the peak in September 2000 preceded the recession that began in March 2001.

Strategies for Mitigating Bear Market Risks

Predicting the start of a bear market is challenging, but investors can adopt strategies to fortify their portfolios:

As of September 29, 2023, the S&P 500 has returned an average of +11.5% since 1928. Most stock market cycles have favored bull markets, indicating a prevailing trend of growth over decline in the long-term.

Sector Diversification: Allocating investments across various sectors can be beneficial. Cyclical sectors like technology and real estate often excel in bull markets, while defensive sectors like consumer staples are more resilient in downturns.

Asset Class Diversification: Integrating bonds offers risk mitigation due to their consistent cash flows and low correlation with stocks. Additionally, international stocks, less linked with U.S. equities, provide a buffer in times of domestic market dips.

Embracing an Optimistic Market Perspective

The current trend in the stock market leans positively, with bull markets typically outlasting and outperforming bear markets substantially. As investors traverse the complexities of these cycles, diversification emerges as a fundamental strategy for resilience and leveraging long-term growth opportunities.