The upcoming presidential election has stirred up a unique blend of hype, anxiety, and speculation, creating uncertainty for investors. The financial world braces for potential ripples as candidates make bold promises and voter sentiment shifts. We’ll examine how presidential elections historically affect the stock market and provide insights to help investors navigate this turbulent period.

Investors are particularly concerned about the election’s potential impact on the economy and stock market, given the current socio-political polarization that extends beyond electoral politics. Issues such as foreign policies, immigration, and budget allocation add to the situation’s complexity, making it difficult to predict how these factors will ultimately affect the markets.

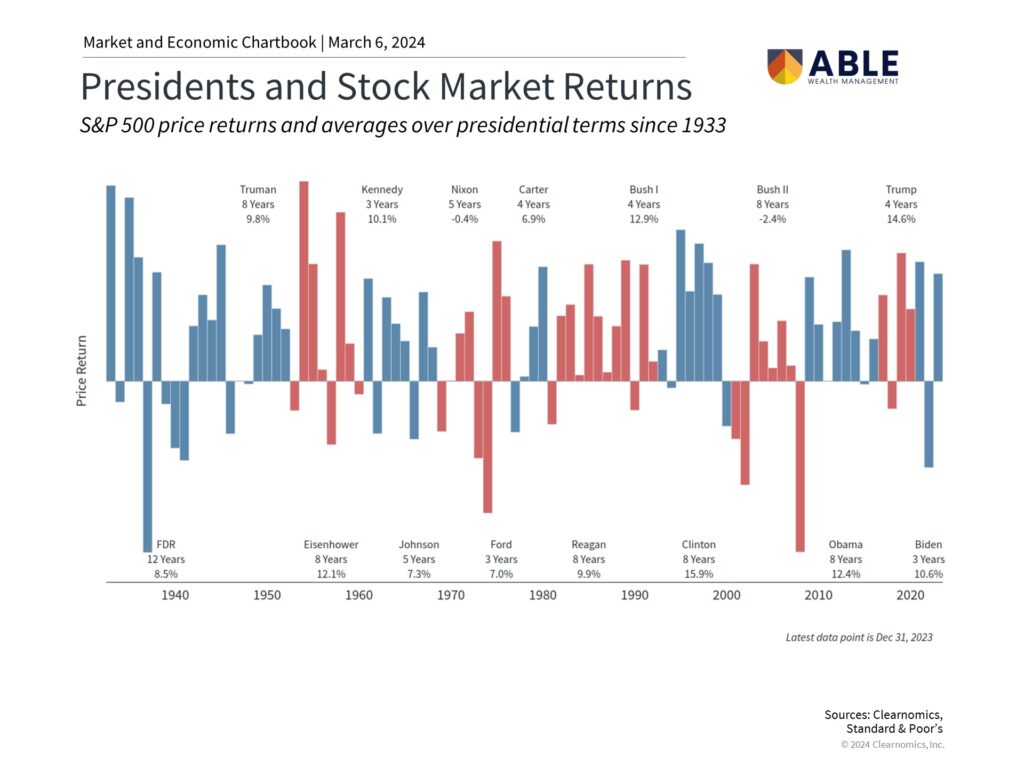

Historical Insights: Presidential Terms and Market Performance

Despite the significance of elections, it’s crucial for investors to base their decisions on sound financial planning rather than being swayed by the political climate. Emotional judgments and political biases should be set aside in favor of a rational approach. During their terms from 2008 to 2020, Presidents Obama and Trump faced numerous challenges, including budgetary conflicts, debt ceiling crises, fiscal cliff standoffs, U.S. credit rating debacles, and major global events like the financial crisis and the COVID-19 pandemic. Despite their differing administrative approaches, the S&P 500 saw a substantial increase in total returns of 236%. However, this growth cannot be attributed solely to government policies; industries and firms also played a role by adapting to market changes triggered by government actions.

Analyzing Policy Impact on Economic and Market Dynamics

Evaluating the impact of policy changes on the economy and markets has historically proven erratic. Tax laws, industrial activities, trade associations, and antitrust can significantly transform specific sectors, influencing the broader economic structure. Companies and sectors consistently moderate their strategies based on new policies introduced.

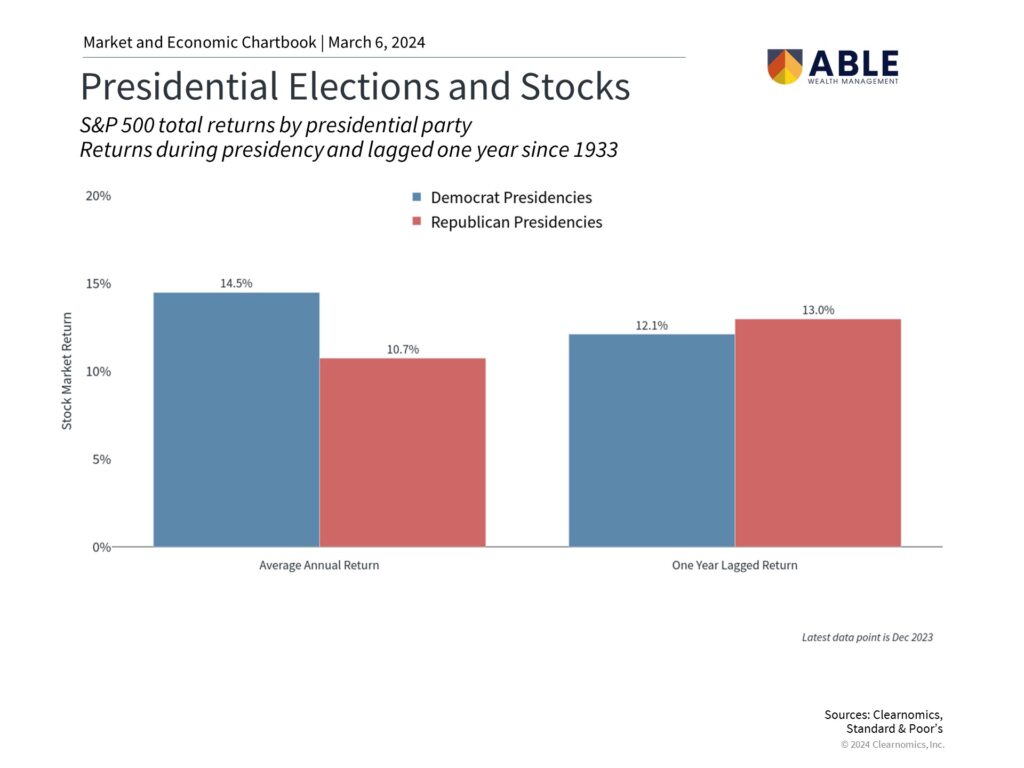

Regardless of which party controls the White House, the S&P 500 has commonly returned double-digit growth. Positive market returns are a historical norm, and investors should maintain a balanced approach to benefit in the long term beyond the emotions of an election year.