Recently, the market dipped into correction territory, typically characterized as a 10% drop from the previous peak, creating a contradiction with numerous indicators of a robust underlying economy. Since July’s end, the S&P 500 has retreated by 10.3% due to factors such as rising interest rates, Fed policy, sluggish growth in China, political uncertainty in Washington, and more. Even at its recent peak, the market hadn’t fully rebounded from the previous year’s bear market, falling short of its all-time high by 4.3% at 2022’s onset. However, the S&P 500 has still seen a 7.2% gain year-to-date, with the Nasdaq rising 20.8%.

Tech Stocks Driving Market Volatility

Amid these macroeconomic concerns, technology stocks have been pivotal in both the highs and lows of major indices. A cluster of these high-performing stocks, now dubbed the “Magnificent 7” – Apple, Microsoft, Alphabet, Amazon, Meta, Nvidia, and Tesla – have seen an average gain of 77% in 2023, significantly influencing the returns of both the Nasdaq and S&P 500. Over the past five years, they have soared 211%, compared to 41% for the Nasdaq and 27% for the S&P 500.

The Impact of Rising Interest Rates on Tech Stocks

Two conflicting forces affecting tech sector volatility are enthusiasm for emerging technologies such as artificial intelligence and rising interest rates. When interest rates increase, the value of future money diminishes. This means that rising rates present more appealing investment opportunities. This can disproportionately impact tech stocks as they rely on the promise of future innovation and commercialization, which could be years or even decades away. With the 10-year Treasury yield briefly surpassing 5%, the highest level since 2007, interest rates have not only risen but have also dragged down the overall market.

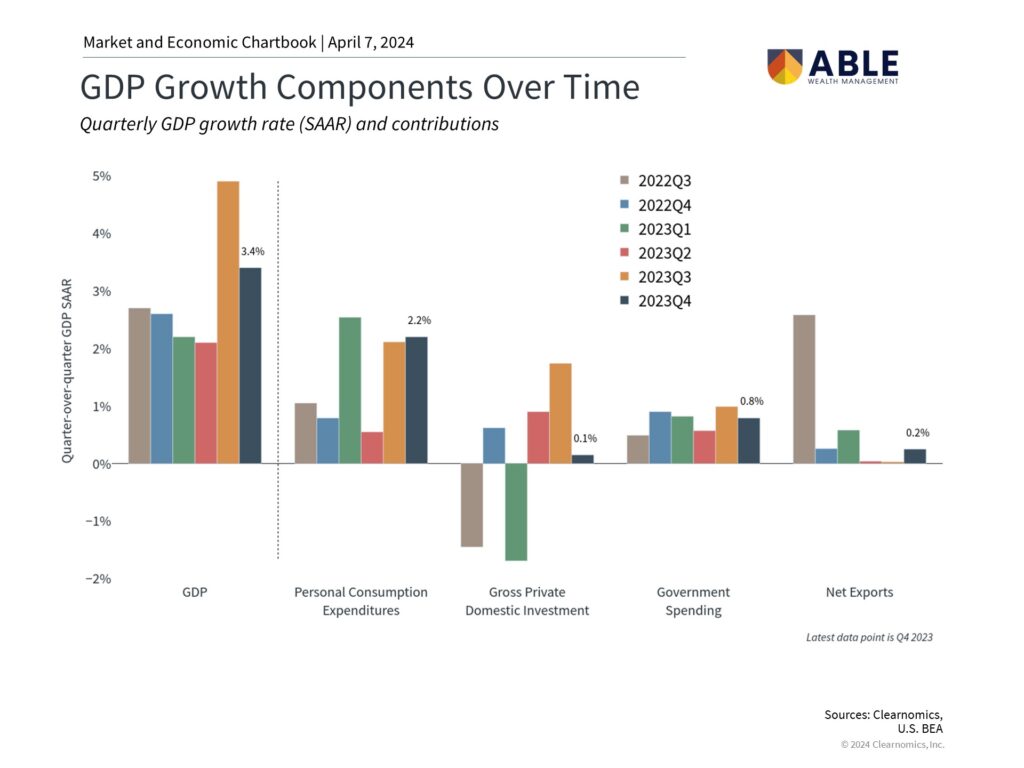

Stronger Than Anticipated Economy

The cognitive dissonance for some investors may stem from these market shifts occurring while the economy is performing significantly better than previously expected. The recent third-quarter GDP report exceeded economists’ predictions from just a few months prior. The economy grew at an annualized rate of 4.9% quarter-over-quarter, even after adjusting for inflation, with growth spanning consumer goods and services purchases, business investment, and government spending.

Concerns Over Future Growth

However, some investors are understandably apprehensive about the sustainability of this growth, fearing a potential recession if rates stay high and the Fed tightens further. There are also concerns that consumer spending could slow as households deplete their excess savings and private investment could decelerate as business inventory buildup reverses.

Navigating Market Corrections

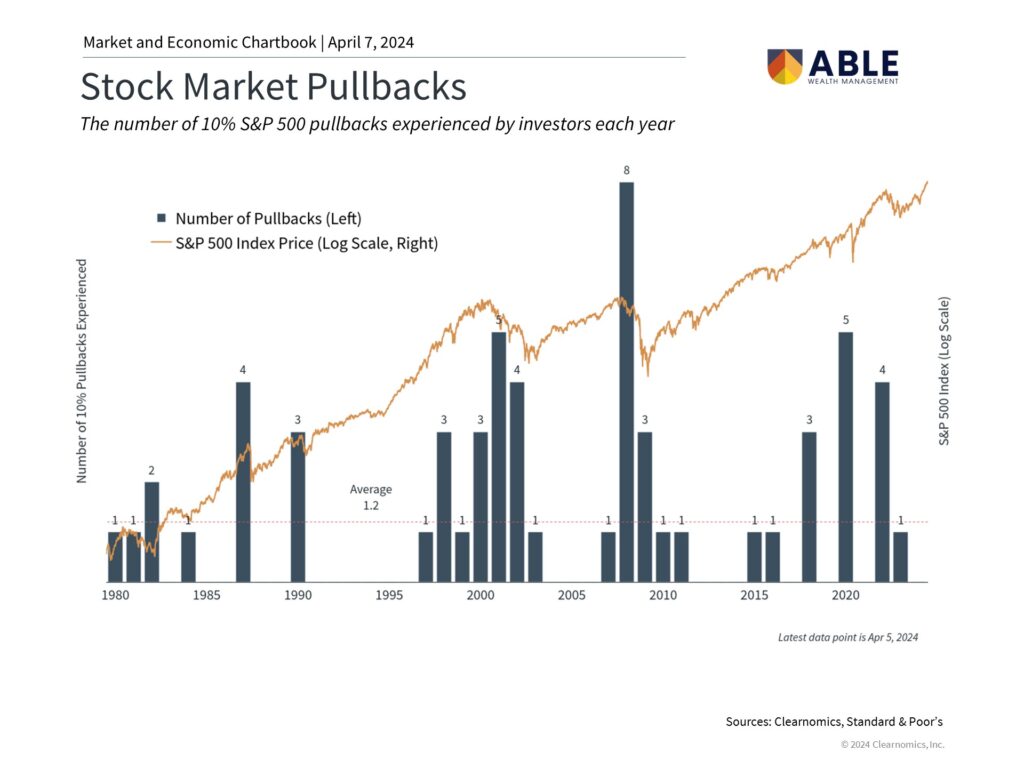

So, how should investors respond when markets tumble despite strong fundamentals? The chart above serves as a reminder that market corrections are a routine part of both good and bad years, even during strong bull markets. When corrections happen, markets often drop by 14% or more. Despite this, major indices typically recover within a few months.

Conclusion

Despite numerous indicators of economic strength, the market recently dipped into correction territory. Investors should focus on broader trends instead of reacting to daily market fluctuations.